Swissquote Offers Bitcoin custody Service

Last year, the lack of clear regulatory framework and law around cryptocurrency prevented institutional investors from flooding the market and providing enough liquidity for Bitcoin price to spike. Sadly, that didn’t happen, making “Bitcoin predictions of 2019” contingent on institutional investors as the major catalysts that will help boost the price of Bitcoin and the adoption of Bitcoin and other cryptocurrencies such as Litecoin and XRP.

But now that’s all changing, with one Swiss bank making the difference.

Swissquote is partnering with Crypto storage

Swissquote Now Offers Bitcoin Custody Services

The naysayers were plenty, but Swissquote announced on Friday March 8th 2019, that the platform has partnered with Crypto Storage to facilitate the provision of Bitcoin custody services. This will allow institutional investors to make cryptocurreny transfers between their Swissquote accounts and external wallets. What does this mean? You can now buy and sell bitcoin and other cryptocurrency through Swissquote. To the moon everybody?

Could Bitcoin prices go up with Swissquote announcement of trading services

Swissquote seems to be on the crypto bandwagon. Two years ago, the major online banking group launched a cryptocurrency trading system that allows clients to trade BTC, LTC, ETH and XRP. If you have never heard of them, you should start to learn more, since they have a market valuation of $618million.

Crypto Storage, a well known FinTech company already has a proprietary infrastructural solution that allows users to digitally and physically manage their private keys on high grade security modules. It’s similar to the modules used by Swiss National Bank, which makes the potential to make Bitcoin custody services even better than before.

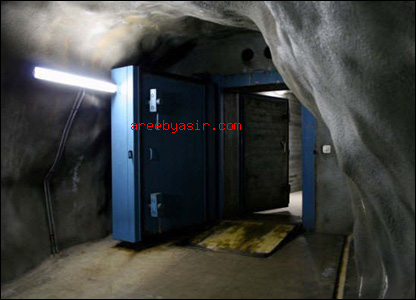

Crypto Storage hides the private keys by printing on paper, and all of the keys inside a military bunker in a secret location- these bunkers are said to be so strong that it won’t even be affected by nuclear bombs. You might actually die but your crypto won’t. But I guess at that point, you won’t really care about your bitcoin.

Crypto Storage & Swissquote can keep your crypto safe underground nuclear bunkers

Personally, I like to keep my keys and wallets in my control, however,I see the reality for mainstream crypto and not everyone is a blockchain expert. So a service like Crypto Storage partnering up with Swissquote will make it adoptable- which is the end goal of the cryptoverse. The only bad thing I see with this, is that someone has physical access to these keys, and they could run off with everybody’s money, or if they forbid you to gain access. The point is that you don’t really have control over your wallet, or keys which means you don’t really have control over your money, I guess you could have your own copy but it’s nerve wrecking – for example, Quadriga comes to mind.

Swissquote is trying to get into the Asian market, and have already said that they will be listing 14 Asian based exchanges on it’s platform.

Will Swissquote Make Bitcoin Skyrocket

The company expanding it’s services and the making of the trading service with Cold Storage will for sure bring trading services to a larger market. But the company will first take a $10 million hit from profits to expand. Which means that the products and services Swissquote offers are going to yield maximum earnings. It offering this custody service for Bitcoin means that they see the potential for Bitcoin and see’s the value of the blockchain and cryptocurrency possibly replacing to an extent (if not completely) fiat currency.

If you think about it, digital money is the next natural step in the future, like AI and AR, FinTech will naturally take a more prominent role in our lives in the next 50 years.

This move by Swissquote also shows that there is demand, high demand from institutional investors for cryptocurrency. Bitcoin is struggling to cross over the $4000 mark, this news might help bring up the price of BTC. And as more and more banks enter the cryptoverse, supporting bitcoin, the easier adoption will take place.

In Canada, I see this taking a long time. Large Banks like CIBC have been outright freezing or blocking cryptocurrency. If you use your credit card to purchase cryptocurrency it will be blocked or flagged. One of my friends had to call them up and demand they let him do what he wishes with his money- which is why something like cryptocurrency is needed. There is a clear vendetta here from the large banks to not support and try to demonize and kill cryptocurrency as much as possible- after all, cryptocurrency is their biggest competition and threat.

I, for one am very excited about this news and if Swissquote will allow for foreigners to sign up, I’ll do it! I hope more banks get onboard.

What are your thoughts? Will Bitcoin soar once again as more and more bank adoption occurs?

Cheers,

A.Yasir