Should You Care What Billionaires Say About Bitcoin?

Oh, the games we play.

Elon Musk, Snopp Dogg, the Winklevoss twins, and Akon have all expressed support for Bitcoin and cryptocurrencies. There are plenty of Billionaire philanthropists who are completely against the tech- one, in particular, equating it to harvesting baby brains.

Bill Gates, Buffett, and Munger have all gone on record to say: don’t do Bitcoin. Bill Gates in particular warned that people who don’t have Elon Musk money should be careful in investing in Bitcoin & cryptocurrencies. You can tell a lot of times these Billionaires, yes unfortunately even Bill Gates, don’t know what they’re talking about. Don’t get me wrong, I actually really like Bill Gates a lot- he brought PC to the home. However, this is one thing, I just can’t agree with. Because they completely miss coins like Akoin and BTT who are pretty cheap and are actual projects that do something- giving it their value. They focus on Bitcoin, hoping that you’re going to equate that to all crypto and just not invest in anything that is crypto. It’s supposed to create fear.

It’s a strategy used by many corporations and governments, and now you’re used to hearing it and seeing it, to the point where when someone with some cred says anything you are more inclined to believe it. Remember, at one time, Bill Gates was against Open Source. So, Billionaires aren’t always right. He tried to protect Microsoft by shutting down OpenSource until he gave in and accepted it.

No one is perfect. I am not either and this article can be fear-mongering too, but from my DNA as the great-grandchild of Chinese workers, my instinct when a wealthy white man is telling me what’s best for me is to listen to him, makes me uncomfortable. That goes for even Elon Musk, who gained his wealth off of an apartheid Emerald mine in Africa willed to him by his father. I have to apply my own common sense, research, and thought.

Bitcoin is king because it was the first of its kind to really get out there in the mainstream and pull something fierce into the market that shocked legacy investors like Buffett.

As a technology person myself, I think Bitcoin has its holes and it’s extremely risky, but here’s a big idea: it’s the next natural step in money- to make it digital. Think about it, you’re already doing debit cards, not physical cash. Fiat is made from thin air, it’s not made from copper, bronze, silver, or gold coins which actually had value. Money is made from killing millions of hectares of trees to make paper money, or plastic money like we have in Canada. The carbon footprint of fiat is about the same or more than cryptocurrencies.

Its annual operating expenses reached $5.4 billion in fiscal year 2017. Its larger competitor Visa had running costs of $6.2 billion.

The tech in me is shouting at the computer screen at Buffett saying ‘WHY OLD MAN WHY?” while the investor in me is sipping tea and saying “There is some truth to what you speak my good sir”. How do I reconcile these two beliefs? Well, that’s easy, with reality. The reality is, if half of the investors on the stock market pulled out today, people like Buffett, Bill Gates, and Munger stand to lose a lot. As we saw with Gamestop, they fear the normies realizing what’s happening. We’re being played.

The fact is, Gates is right, unless we have Elon Musk money, we cannot make billions off the stock market either, but we have a chance of achieving that with cryptocurrencies and Bitcoin.

In Dec 2019 I bought $200 of Bitcoin for my nephew as a gift for his birthday. Today it’s worth $1200. I just gave this 2-year-old a gift that could potentially rise even more as the years tick by. He has a chance of actual wealth by the time he’s 20. Someone who is looking to build wealth will look at the stock market and see that Barrick Gold is $18.97 today. If that person has $200, he can buy 10.5 shares. Let’s say he takes that to Dogecoin instead, he will have 4166 dogecoins @.048. When that doge goes to .058 he will make $41. Barrick Gold goes up by .10 to $19.07 for the 10.5 shares, he will have a profit of $20.02.

How are you supposed to build generational wealth like Buffett and Munger when you have normal people money?

What About African Wealth?

I put money into Akoin because that is one project I hold dear to my heart. I want to see Africa built up. It has so much wealth that continues to be stolen from them and what Akon is doing with Akoin is incredible. Many African countries like Zimbabwe, Botswana, Ghana, Kenya, Nigeria, parts of South Africa are using Bitcoin instead of their own currencies in some cases. This is going to help build wealth for many Africans and African businesses. With Akoin, the potential is limitless.

So why does someone like Bill Gates who wants to use his philanthropy to help people, not want to see Africa building itself and stopping the wealth theft? Why do Buffett and Munger not see the value of African nations using crypto to create more opportunities for themselves and their businesses? Many average Africans, just like us average westerners, don’t have Musk money, so why should they stop you from using Bitcoin and crypto as a means for wealth building instead of using paper money? Because we’re not following a controllable mold?

I bought Akoin because I believe in Akon and I believe in what he’s doing for Africans! I absolutely encourage you to do so too. I encourage Bill Gates to put his money where his mouth is and support it too. He’s a tech guy, he should know the value in this technology and supporting something like the Akoin project.

The Motivation Behind Buffett, Gates, and Munger?

Like I said before if half the people investing in the stock market pulled out tomorrow, Stocks would plummet. That would be almost half their wealth gone overnight. The crash they warn you about with Bitcoin can and has happened on the stock market before. In fact, billionaire investor Jim Rogers warns about a ‘depression’ level crash that will be worse than the one he’s lived through.

But with the way Buffett, Munger, and Gates speak, it sounds like only Bitcoin and crypto are capable of having massive tankings. Why do you think Buffett moved his money out of Goldman Sachs and into Barrick Gold- Gold being something he’s been against for a while now? I might add that Buffett defended Goldman Sachs for their conduct and responsibility for the 1MDB scandal, blaming the victims for being stupid enough to sign a contract like that. He defends Coco-Cola regardless of their horrible track record in poisoning waters in India and contributing to obesity and faking reports to suggest it didn’t cause health issues.

Gates is no better. A philanthropist who flies private jets as his ‘guilty pleasure’ but tells you to make changes to your life because you’re peasants and must for the sake of the planet. He invested heavily in G4S until he was blasted for it and was pressured to pull out. In 2019, the Gates Foundation upped its stakes in for-profit prisons in the UK. I’m not saying they’re bad people, but they are no Saints when it comes to investing in companies that ruin lives- the same goes for crypto- which has had its share of crimes.

They have made literal millions off of sketchy stocks and companies while telling you to stay invested in the stocks because if you didn’t, they would lose that wealth they built up.

Would Bill Gates tell you to stop using Windows 2019 server because of the sheer amount of energy it uses and tell you to go back to Windows 3? Would you even if he did? I couldn’t, I love that 2019 server too damn much. I’m sorry planet.

Tech Companies could right now invest millions to make their companies more climate efficient, but they won’t. But you have to stop mining that Bitcoin- it’s polluting the planet.

If you still think Billionaires will save us, have a watch of this:

Millennials Don’t Have Buffett Money

One of the biggest reasons, aside from the tech side of blockchain and crytpo, and my support for Africa to take back wealth, is for the Millenials. I look at my younger cousins and see them grinding and working hard. They’re getting paid meager wages for management-level work, they have student debt as well as living expenses. Some of my cousins are just graduating from high school and worried about their future, how will they afford a home, a family, or even just to live, forget about savings?

I have cousins who are still getting their education, worried about if a job will be enough to support a family. Believe it or not, Millennials are NOT lazy they are just dealt poor cards. They aren’t all partying and Instagram posing. They think about their future, their life plan, if they can afford to marry or not, or to have kids or not. They have deep thoughts and worries that many of my parent’s generation didn’t have to worry about or factor too much. My parents paid $800 a month for their mortgage with an 18% interest rate, but still, my dad was just a normal worker and my mother stayed home with us. Now, that is almost impossible to do for many families today. The average rent for students alone is $1000 to be near their school, transport, food, which is on top of their textbooks and tuition. The average family who is renting is paying almost $5k in monthly expenses– the cost of living and housing- forget about saving. The average pay for an individual is about $50k-$78k salary. To own a home and survive, both parents need to be making the top tier of that or have better-paying careers.

Billionaires want to tell you, don’t even think about putting that $100 you saved up from not drinking Starbucks into bitcoin. But instead, let it sit in a term deposit and watch it grow a penny after 9 months. Or toss it into a stock that is already owned by a Billionaire for millions of shares.

Now I don’t want my cousins or any Millenials to rush out and pull together their hard-earned money to buy crypto. I’m just saying give them a chance to think, research, and learn. I have a good friend from the New York Stock Exchange who told me this: Bitcoin & Crypto are the beginning of generational wealth and the Millennials can get in still. And I believe it. I gift in Bitcoin. My Lunar New Year gifts were, again this year, in Bitcoin, Tron, BTT, and XRP. Eid gifts this year again will be either BTT, Akoin, or Bitcoin. I can’t easily gift stocks to my cousins. If the crypto rises and they make extra money, great. If it doesn’t, I was fine with that much loss. It’s the same gamble you take with stocks, real estate, and gold. If you buy at the high, you might have to sell at the low, but remember the name of the game is “Buy Low, Sell High”.

Change Is Hard, But You Have To Do It.

Progress, in any time has always been hard. I remember people NOT wanting to switch from cash to debit cards. I remember a time when people hesitated buying online- something we cannot even imagine today. Unfortunately, companies that refused to even have a website, failed hard during the pandemic.

Oil companies spend billions to show they care about climate change and hinder progress for cleaner energy. Houses for example are still made with the same technology, when solar panels, geothermal, and other tech are available. Houses cost over a million dollars but are made with what I call sub-standard energy-efficient insulation, windows, and energy sources. The government has made no effort in changing rules and laws on building homes with these new technologies. The question is why?

Take the Kinder Morgan ordeal, which goes back to 2017. I support Indigenous land rights, clean drinking water for our Indigenous communities, and cleaner energy- that’s progress. Oil isn’t compatible with those values.

Coco cola did this to make everyone drink coke all the time while refusing to stop using plastic bottles- a cleaner safer option. Monsanto’s safer than salt’ campaign- which refuses to label GMO products or switch to safer non-cancer-causing chemicals.

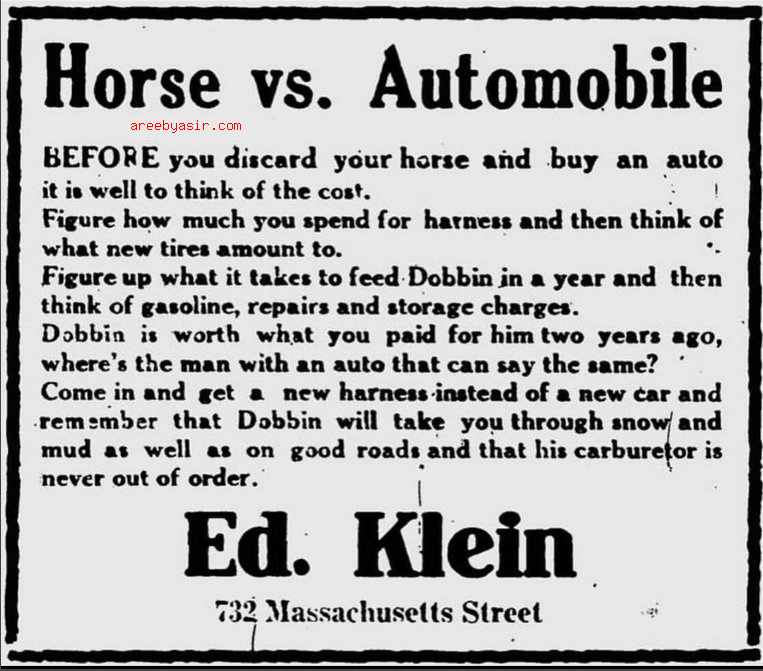

Oh! Remember that time when people who sold horses tried to make cars sound bad? Yeah, it happened. Entire industries were destroyed because of progress, and they fought hard to save themselves but in the end, they just didn’t adapt. In some cases, things that are progressive are often made to look wild and crazy and bad…Kind of like what happened to Nikola Tesla– his product and ideas were clearly better and were progressive (FREE ENERGY FOR EVERYONE)…but that’s not what was marketed to the public at the time.

Horses are superior, you know their names.

Should You Tank the Stock Market?

If you got a bunch of heroes on Reddit who decided let’s just break this whole damn system, maybe it will all break apart at its fragile seems. What the ‘commoner’ did with GameStop is exactly what Hedge Fund companies on Wall Street do daily- except these Reddit Heroes gave them a taste of the same medicine. What happened with GameStop is basically rooting out the ugly underbelly of what is wrong with the current financial system. This article here is actually garnering sympathy for the poor unfortunate millionaire investors who screw everyday people, daily.

The housing market here in BC has seen a magnificent boom and the context behind why it did, is still very floppy- shifting blame from money launderers to just people panic buying during COVID. Normal people do not have the money to panic buy a million-dollar home.

What should a normal person just trying to create wealth than do when investing then? Do both? Crypto and stocks. Why do you have to do just one? Do a bit of good stocks that you understand and do some bitcoin or other crypto-that you understand. It doesn’t even have to be much. Just like I did for my nephew, just $200. Set aside a bit of money and research and learn about the different crypto like you would stocks. I have always looked at Jim Rogers for advice and his advice is solid, don’t invest in what you don’t know. Which is why he hasn’t bought Bitcoin because he simply doesn’t understand it.

Motley Fool in 2018 told everyone Bitcoin is poop (when Bitcoin was $6000), now they’re tweeting how amazing it is and how they’re going in too. If you listened to them in 2014, you missed out on a buying opportunity. By the time they announced their verdict, Bitcoin was already climbing up to $55k. You can still get in believe it or not, because nobody knows how high it will go. It might tank to zero, so invest what you can stand to lose. But that goes for the stock market too.

Mr. Wonderful, Kevin O’Leary, who spat on Bitcoin like it was mud, is now declaring he will be making 3% of his portfolio Bitcoin.

Goldman Sachs is also jumping back into cryptocurrency trading,

It’s come to the point where Banks can no longer deny the value of Bitcoin and crypto.

Motley Fool was against Bitcoin in 2018

Motley Fool in support of Bitcoin at the high in 2021

Well, What About Banks?

This quote was immediately played down by CitiBank realizing what it had done. Yes, banks have a motivation to stop bitcoin. Did you think they’re just being nice? All of these billionaires and Banks and even governments and corporations have a motivation to put down Bitcoin (even China). It’s a direct threat to their institution like pedestrians were a problem for car makers– it’s an interesting eye-opening video. Just like Black freedom and rights are a threat to white privilege. Just like Amazon is a threat to small businesses. Just like inflation is a threat to our money- it devalues your hard-earned cash and is spun around to seem like a good thing. In a nutshell, you need to invest your money because it’s being devalued from the moment before it’s even made. Banks tell you don’t buy gold or silver, but historically, that’s the only thing that is stable. Hence why Buffett moved millions to gold- he’s anticipating a crash and he needs to hedge his portfolio. He has always hated gold and pushed against it.

But going back to Banks, they hate Bitcoin for many reasons but the main reason is that it’s Bitcoin. They’re going to say things like ‘money laundering!’ and ‘crime’. But those things happen way more aggressively with money than Bitcoin- especially because Bitcoin is not private you can see where the money is going.

Chinese money launderers brought in billions of dollars which they funneled through real estate for years under the watchful eye of our current government, and nobody did anything. Now, they seek a fall-out guy at the Casinos to take the blame for the crimes they allowed to happen.

Banks handled these transactions, these wires, these dollars in fiat, helping to fuel (in portion) a housing situation in Canada. Bitcoin is hard to hide, all the transactions are on the public ledger, you can watch it, you can see where it’s going and what it’s doing. Yes Bitcoin can and is being used for crime, but so is fiat, so are stock markets, so is gold, and anything with value. Thus proving, Bitcoin’s value.

Known crime organizations are thriving with businesses and real estate and there doesn’t seem to be any worry about how these transactions impact our daily lives, our economy, and other factors.

In the grand scheme of things, cash is used in more crimes than bitcoin. So, those equating it to be worse than normal currency need to collect their thoughts better. If you’re truly against financial crimes being committed then maybe you should talk about how much cash is a problem, alongside government bodies allowing crime money to filter into real estate. But people aren’t going to do that, because crime fuels economies and breaks economies too, it’s complex and it’s what we know as a standard of buying and selling goods. Bitcoin is just easier to attack- it’s new, complicated tech, not easy to understand, and not as easy as going to the ATM and withdrawing cash. You can’t just go to a bank teller and be like withdraw me some bitcoin, pay my bills in bitcoin. But imagine, if Banks did get on board (which they are going to-they don’t have a choice), and the world starts the shift now as we did in the ’90s with debit cards. It is, as I’ve said, the next natural step: to go digital.

Nothing is safe from criminals, which is why Banks, governments, and people need to start looking at crypto for the long haul. It absolutely has the applications needed to help stop money laundering but at the same time, allow people to be their own banks and safely keep private their finances. Just because you have nothing to hide, doesn’t mean you shouldn’t keep your finances just as private as your bathroom breaks. It’s your right to remain private.

But You Don’t Have Bitcoin Money.

So, you don’t have $50k to just throw down because you are not Warren Buffett and aren’t the rich love child of Elon Musk. There are other opportunities for buying crypto. Unfortunately, I wasn’t gifted an apartheid emerald mine by my father. And I’m not the great-grandson of the head of the Seattle Federal Reserve.

No, my Chinese great grandfather got his hands dirty by working on his potato farm, fighting off racism, and building their bloodline to know that hard work is HARD. Money doesn’t just come to you. You have to scrape your skin for that dollar. What I have today, was done with a lot of patience, a lot of blood, sweat, and tears (yes literal tears).

You saved $20 this week because that is all you could, that’s hard-earned money and you should take pride in that $20. Nothing is more devaluing than devaluing your own effort. You should be damn proud of yourself. So I understand, you don’t just want to blow that hard-earned $20 just like that.

There are options to get in for some other potential coins. I present the following coins, but by all means, these are just the coins I find interesting and it is NOT in any way meant to be advice. That is your hard-earned money, it has great value to you and should not easily be invested without knowing what the hell you’re doing.

Coins like:

- Dogecoin -which Elon says will be the crypto of Mars, I believe it. Because that man says a lot of crazy stuff then he does it.

- BTT- which is the Bit Torrent coin running on the Tron network, it’s an actual project and there’s buzz for it, it’s said to be a dollar by summer 2021. If there is one coin that China might partner with for their Digital Yuan, it’s going to be Tron or BTT. Have a look at both.

- Akoin- which you already know because Africa is going to be big.

- Lumens has great potential.

- XRP– is not going anywhere, it might surpass Ethereum as more banks use it. (Standard Charter, one of the largest Banks in the world is using XRP network)

- Ethereum– I’m not a fan because of the fee’s and it’s about $1600 right now, but it’s a strong 2nd to Bitcoin but not as expensive. There’s buzz for it to be $4000 end of this year.

- Crypto.com- which is already out in Singapore and Malaysia and not far from reaching other Asian markets. They’re working with Visa for a rewards card, something Facebook couldn’t pull off.

So much wow when we go to Mars

If you’re curious about Exchanges, I suggest Binance, Coinbase, and even Crypto.com. Please be careful while on the exchanges, there are hacks and stolen coins sometimes. Always make sure that you are safe and secure (my free Cryptocurrency OS can store many common coins and tokens) !

Not interested in Coins? Have a look at Buffett’s portfolio, Gates’s and Jim Rogers’s portfolio.

- Utilities that pay dividends

- Solar and energy companies

- Agriculture- because everyone needs to eat

- Gold – despite what they say, banks are still hoarding gold bricks and trade in gold

- Copper and silver

- Tech companies – Tesla is not going anywhere, neither is Artificial Intelligence and facial recognition

- If you want to invest in SpaceX but can’t, invest in companies that invested in SpaceX

- Chinese companies that are basically going to take over the world- start learning mandarin 😛

There is a lot to learn from billionaires in terms of finance, world and politics but should we listen to everything they say? Well, if they have ulterior motivations to protect what they have at the expense of the rest of us, then no. Don’t listen to them. Do your research with context, don’t just scroll through the news article, find articles that tell you the flaws of the coins or stocks, because nothing is 100% perfect.

Don’t just listen to Elon Musk, don’t just buy Bitcoin after mortgaging your home or sell a kidney. Don’t just do things blindly.

And don’t rely on the Billionaires to save us. The rest of us, the remaining 80% of us, need to plan what is going to make us wealthy, like how these Billionaires made themselves wealthy. But don’t forget, not all Billionaires started from the bottom, many like Bill Gates, Warren Buffett, Elon Musk, and Munger were born into wealth. They had every privilege and access that you do not have. They just did things cleverly and utilized what was at their disposal. They were creative and smart with their choices. They got educated, they learned beyond school, they took chances and thought on a different level. Your situation, upbringing, and access might be different.

Warren Buffett saying no to crypto

So what say you, my friends? Shall we start our generational wealth revolution now?

As with anything finance-related, I am not a financial planner. This isn’t actual financial advice. What works for me and others may not fit your financial goals and ability. Always do your own research, look to people like Buffett and Elon Musk and Munger and Bill Gates, but think for yourself. Elon told you to buy bitcoin, but Gates said not to. Why do these 2 billionaires have such differing opinions? Learn about the gap, fill in your own knowledge, and then do what you think is best for you.

What coins are you interested in? What stocks do you prefer? Share your thoughts in the comments section.

Cheers

Areeb