Ethereum High Transaction Fees/Gas, Tokens and Exchanges = Bad Investment

Unlike many other coins with low withdraw fees and low transaction fees, Ethereum based ERC20 tokens are horribly expensive. If you don’t spend a good amount on them you could actually be unable to purchase any due to the “high gas and transaction fees” of Ethereum, something that has been a huge problem. Even Bitcoin is not as bad in the sense that at least you can just send a maximum amount and not worry about this ridiculous “gas calculation fee” which make Ethereum transactions more difficult and less predictable, and sometimes impossible due to randomly expensive gas prices. You shouldn’t have to be a mathematician or programmer to figure out how to send Ethereum. Unlike more simple, faster and easier to use currencies such as even Litecoin that just work.

Let’s give an example test of what happens if you send .1 Ethereum to an exchange and what it costs you.

I sent about .1 ETH to an exchange (about $100 USD) and the transaction fee was about $2.34.

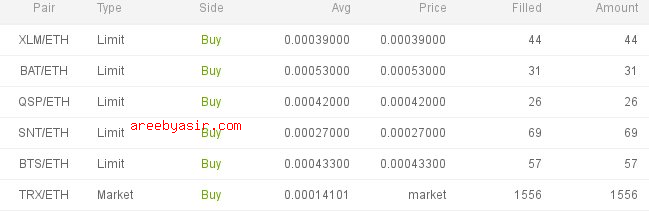

I’ll show you what I mean and part of this is Binance but not exactly, their ERC20 Tokens have a high fee because they are expensive to send! Compare this to a small amount of XLM I bought and sold.

Here is a good example of BAT I purchased 31 of them. When I withdrew I only received 9.969!

Another example is SNT I purchased 69 but only received 36.931!

I already have XLM but to illustrate the difference see how much better it is to buy non ERC20 tokens, you lose so much value in sending ETH and then sending them back to your wallet.

I bought 44 XLM (Stellar Lumens) and was able to withdraw and receive 43.946! Talk about low withdrawal fees. It’s not Binance trying to rip us off but it comes down the high gas fees for these ERC20 Ethereum based tokens. Unless you are buying a minimum of hundreds of thousands of these tokens they are simply not worth it. This is strong disincentive for many to add to their position vs the low fees of buying other non ERC20 tokens. I’ll go so far as to say Ethereum is disrupting trade with their high fees, not only this but ERC20 tokens will not grow for long with these kinds of ridiculous fees. If the token/currency cannot be easily, quickly and affordably traded they will probably not have a strong future once others catch on.

Buying ERC20 tokens on Binance

Withdrawing ERC20 tokens on Binance see how little you actually get because of high Ethereum transaction/gas fees!

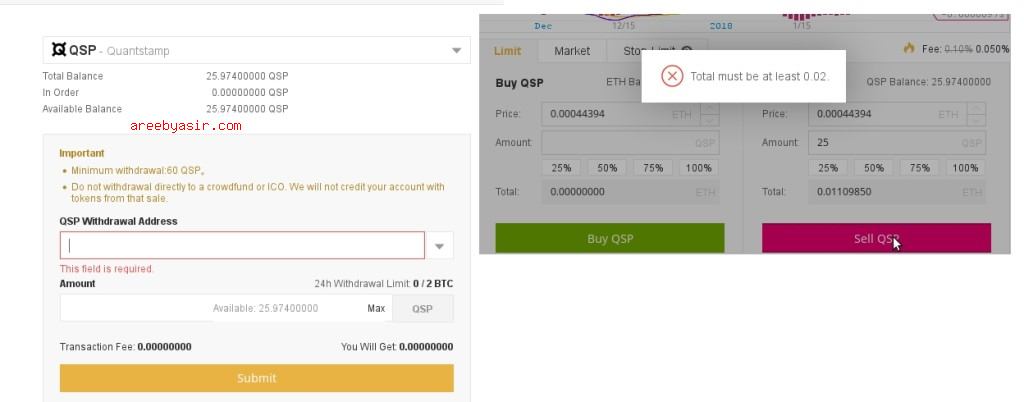

Some tokens get trapped look at what happened to my QSP!

I cannot withdraw it or sell it so it’s stuck in Binance unless the value goes up.

The reason is that Binance’s minimum is 60 QSP due to high transaction fees.

I cannot sell it because the minimum sell on Binance for this coin is 0.02 ETH.

Again this is all down to high transaction fees on these tokens making it impossible.

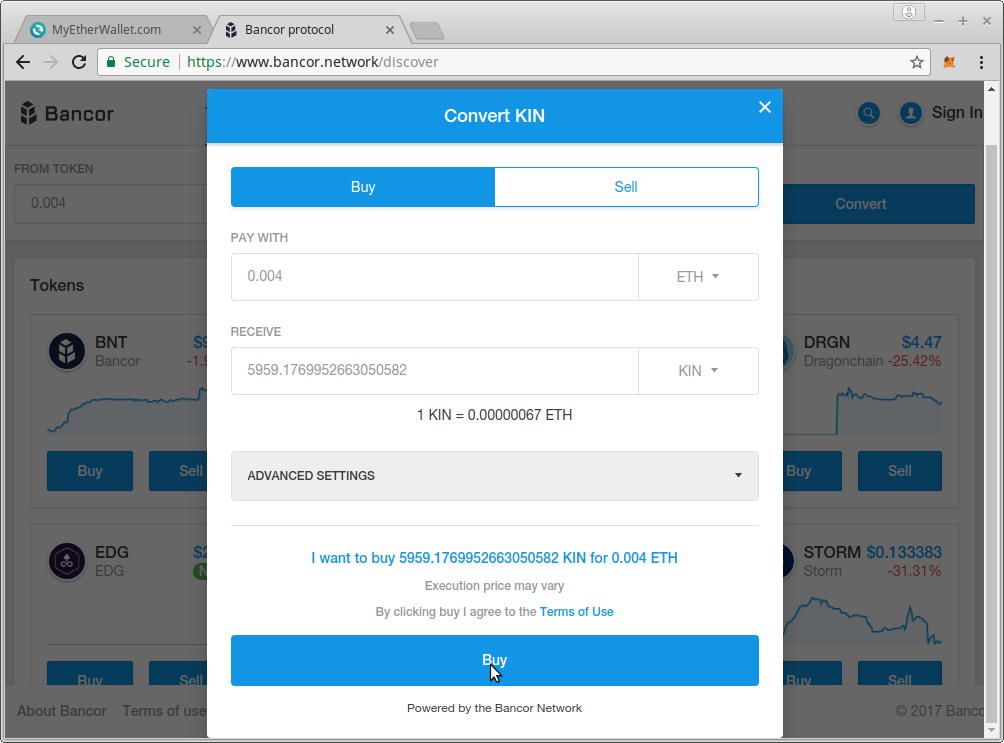

How about trying to buy KIN a new ERC20 Coin? I just want a few thousand of them no problem right?

Me: Good day dear sir! I’d like to buy 5959 KIN the hot new ERC20 token!

Bancor teller: Yes sir that will cost you 0.004 ETH. Let me directly access your Ethereum wallet (promise not to take any of your coins) and process this transaction.

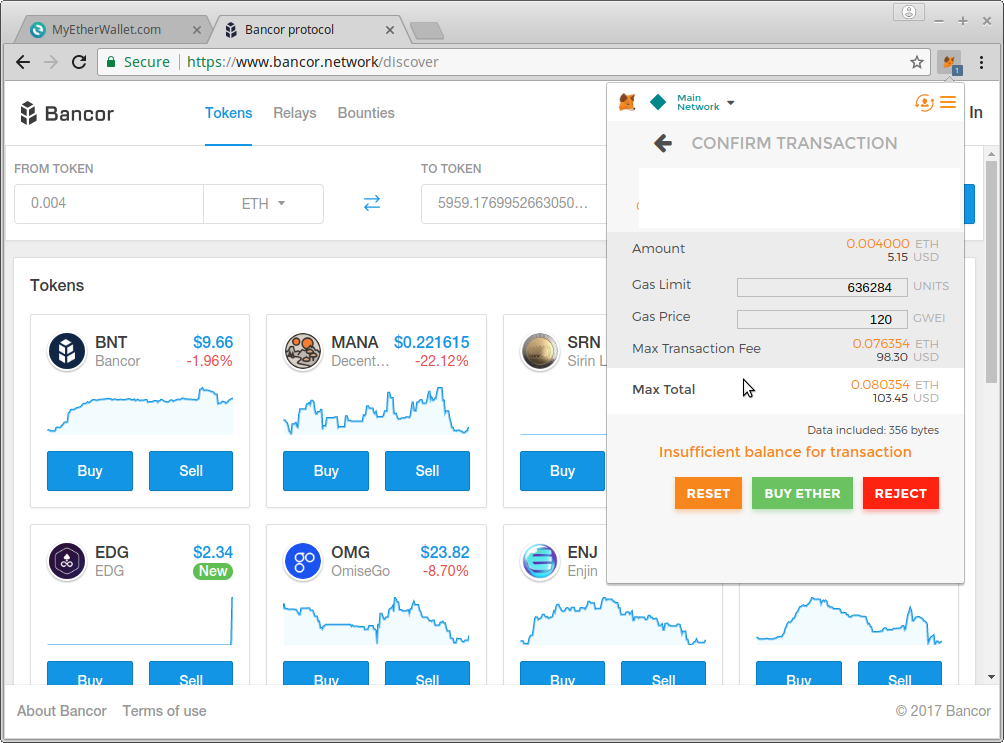

Me: No problem OK I see the transaction request………

Me: Wait……..I am just trying to pay you 0.004 ETH or about $5.15 but the Gas/Transaction Fee is $103.45 or 0.080354 ETH. Sorry this is ridiculous but I’m not paying it and I won’t buy any ERC20 tokens today.

Ethereum and its tokens are conning people out of money and may lead to its own implosion and have a huge impact on ICOs

As we can see above this is just one big problem with Ethereum aside from security, slow transactions and being extremely user unfriendly it’s also unfriendly to your bank account. I predict in the future this will have a massive and negative impact on the crypto industry. As more people find that these tokens are essentially wasted money due to high fees they will eventually start investing in and using proper currencies that work and that have fair fees and higher transaction speed.